Identifying & Validating Blockchain Advantage in B2B Payments

Case Study: Upwork Inc.

Executive Summary

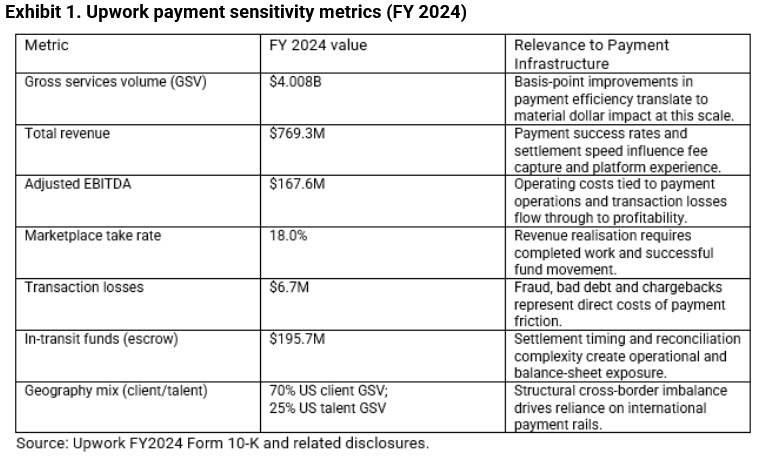

Upwork operates as a two-sided work marketplace that matches businesses with independent professionals and agencies globally. As the platform only monetises when funds clear, are held safely during work and are paid out reliably, payment performance directly influences margin, retention and risk. In 2024, Upwork enabled approximately $4.0B in gross services volume (GSV) and reported $769.3M in revenue and $167.6M in adjusted EBITDA (Upwork Inc., 2025).

This case study examines a specific thesis: the highest-value use case of blockchain infrastructure to Upwork is as a settlement and escrow-state layer deployed in high-friction cross-border corridors, rather than as a wholesale replacement for cards, ACH, banks or compliance operations. A hybrid design can compress post-hold settlement time, reduce payout failures, trace volume and improve reconciliation through transaction traceability.

1. Business & Payments Reality

1.1 Business overview

Upwork connects clients (SMBs and Enterprises) to over 18 million freelancers and agencies across more than 180 countries. Upwork generates the majority of its revenue from service fees on work transactions. It also earns from subscriptions, ads and enterprise services. The platform only gets revenue when work is paid for and funds are sent and received, therefore payment performance directly affects monetization and trust.

Upwork's 2024 financials show that their current use of traditional payment infrastructure directly affects multiple metrics. With $4.0B in GSV and an average take rate of 18%, small efficiency gains matter. The platform holds $195.7M of clients funds and pending payouts, creating reconciliation overhead, while $6.7M in transaction losses reflect direct friction costs. Most importantly, 70% of client spend originates in the U.S. but only 25% of talent is based there which means the majority of payments are across borders, making international payment performance critical to platform reliability.

1.2 Why payments matter: margin, growth and risk

- Margin: Processing fees and payout costs compound quickly across $4.0B in volume - small basis-point changes in payout economics can translate into material EBITDA impact.

- Growth: Slow or failed payouts represent friction that may affect freelancer retention and platform availability, particularly in high-value talent segments.

- Risk: Chargebacks, fraud, sanctions violations and payout failures create direct financial losses and require dedicated operational resources to resolve.

1.3 Current-state payment flow (end-to-end)

Upwork's payment architecture spans multiple stages, each with distinct timing and risk characteristics. Understanding these flows is essential context for evaluating where blockchain-based settlement could add value and where it cannot.

Money moves through Upwork in two primary contract structures: hourly (billed weekly after work is performed) and fixed-price (pre-funded milestones released upon delivery). The platform introduces deliberate hold periods at multiple points to manage disputes, fraud and payment clearing risk. These holds are policy-driven, not rail-driven, switching to stablecoins cannot eliminate them, but it can compress the final settlement leg once funds become withdrawable.

The following figures map each stage of the payment lifecycle, showing where funds reside, the corresponding state on Upwork’s internal ledger and the key risks or frictions at each step. A visual representation of these flows is available at [website URL], which includes an interactive playthrough of each stage.

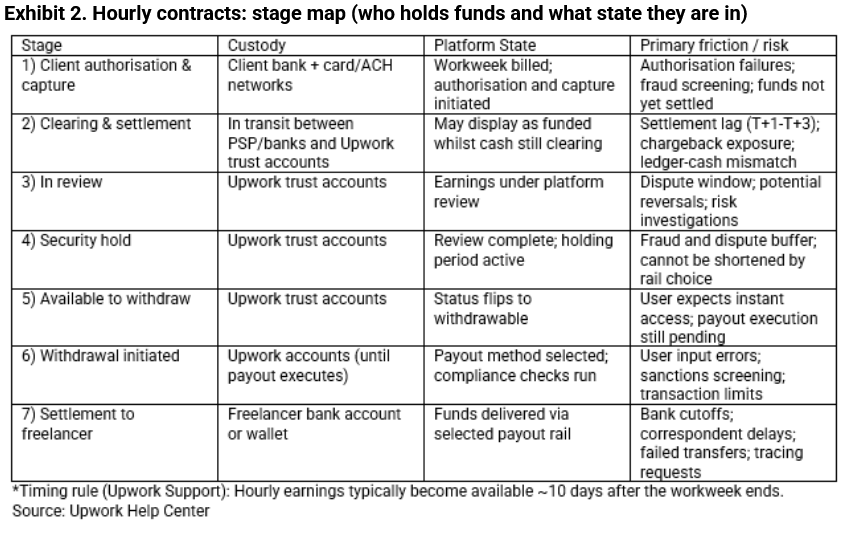

1.3.1 Hourly contracts (today): stages and timing

Hourly contracts are billed weekly. Upwork applies a review and security window before earnings become withdrawable. This is a trust mechanism to manage disputes and payment clearing risk. Stablecoins cannot remove the hold; they can only compress settlement after the hold ends.

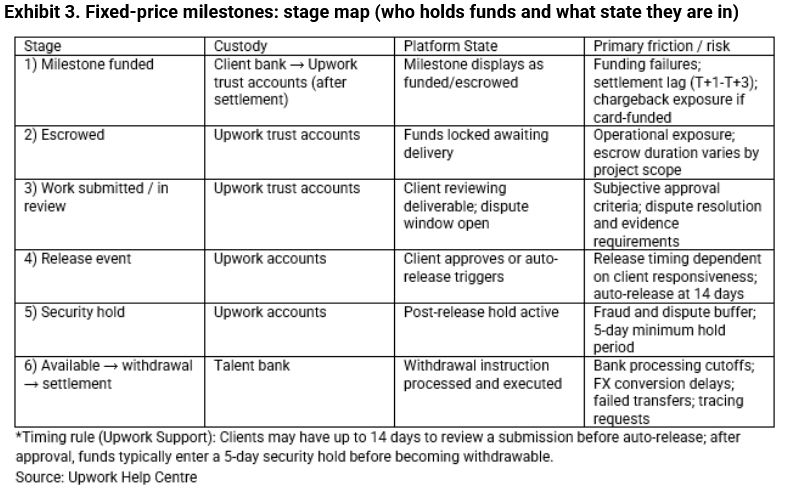

1.3.2 Fixed-price milestones (today): stages and timing

Fixed-price contracts operate on a pre-funded escrow model. Clients deposit funds for a milestone upfront and Upwork holds them until the freelancer delivers and the client approves the work, or until an automatic release is triggered. Once released, funds enter a security hold before becoming available for withdrawal. This structure shifts timing risk: clients commit capital earlier, whilst freelancers face uncertainty around approval and release timing rather than initial funding.

1.4 Key constraints: economic, operational, regulatory and risk-related

Economic constraints: Cross-border payouts stack costs that are difficult to predict at the point of initiation: fixed per-transaction fees, embedded FX spreads and corridor-specific intermediary deductions. Small, frequent withdrawals are disproportionately impacted by fixed-fee structures. Cost opacity, particularly unexpected correspondent bank deductions on receipt can erode trust even when headline fees appear reasonable.

Operational constraints: Payout failures and the need for manual tracing and retries create support load and operational drag. Bank cut-off times, weekends and local holidays produce long-tail delivery times that additional provider integrations only partially mitigate. As payout methods and intermediaries proliferate, reconciling internal ledger states to external settlement events becomes more complex and exception-heavy.

Regulatory and risk constraints: Upwork must maintain robust AML and sanctions controls across jurisdictions, where requirements differ by country and continue to evolve. Payment transparency standards are also tightening globally, with the Financial Action Task Force (FATF) strengthening expectations around originator and beneficiary information, screening, and monitoring for cross-border transfers (Financial Action Task Force, 2025). In the EU, the Markets in Crypto-Assets Regulation (MiCA) establishes a framework for stablecoin issuers and crypto-asset service providers, raising the compliance bar for any stablecoin-enabled payout product offered into the region (European Securities and Markets Authority, 2025).

2. Blockchain Transformation Hypothesis

2.1 What changes: identifying intervention points

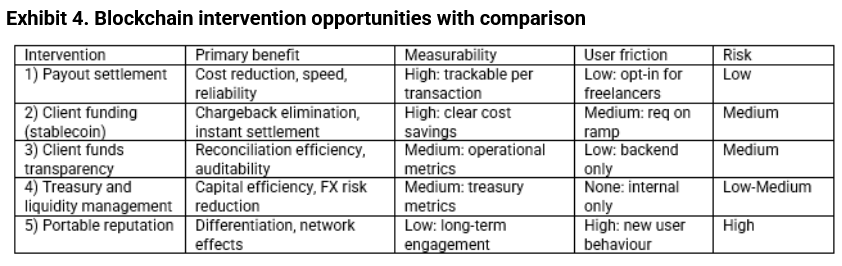

Blockchain can be used to address multiple pain points across Upwork's payment and operational infrastructure, but not all opportunities are equally viable or urgent. The following comparison evaluates five potential intervention points against measurability of impact, user friction, implementation risk and strategic value. The analysis prioritises interventions that deliver near-term ROI with minimal disruption whilst building infrastructure and organisational capability for higher-leverage applications over time.

2.2 Scope of change: what moves on-chain vs stays off-chain

What can move on-chain (narrow, controlled scope):

- Stablecoin payout settlement (Phase 1+): For approved corridors where it is demonstrably faster and cheaper which are legally permissible. This is typically an opt-in payout method for freelancers.

- Internal treasury transfers between Upwork-controlled wallets (Phase 2+): Used for internal liquidity movement however subject to governance, controls and jurisdictional requirements.

- Escrow state transition event logs (Phase 4, optional): Record minimal event metadata (e.g., contract or transaction IDs hashed/salted, timestamps, state transitions), explicitly excluding sensitive contract details.

- Client stablecoin deposits into escrow (Phase 3, optional): Only for select clients and with clear policies for refunds, disputes and error handling. The key is designing the off-chain processes around an on-chain deposit.

- Verifiable credentials for portable reputation (Phase 5, optional): Attestations of work completion/ratings that users can present elsewhere, provided privacy, consent and governance are correctly designed.

What should stay off-chain (core business + regulated processes):

- Client funding via legacy rails (cards, ACH, wires, local bank transfer): These rails remain essential for broad adoption and alignment with existing user expectations. A full migration away from them would likely reduce conversion and slow growth.

- KYC/KYB, AML/sanctions screening, transaction monitoring and regulatory reporting are compliance functions that require controlled data handling and jurisdiction-specific processes.

- Contracts, milestone approvals, dispute adjudication, refunds and customer support are policy-heavy workflows with edge cases that benefit from off-chain handling.

- General ledger, revenue recognition, invoicing and tax reporting financial reporting systems should remain off-chain; on-chain events can be inputs, not the ledger.

- Where existing rails are fast, cheap and reliable, the incremental value of on-chain settlement is likely to be limited initially. The focus should therefore be on freelancers in high-fee or failure-prone cross-border corridors.

- FX execution with licensed partners and banking relationships typically remains with regulated entities; blockchain can reduce settlement friction, but does not replace licensing requirements.

2.3 Why blockchain matters here: capabilities legacy systems cannot deliver

- Always-on settlement windows: On-chain settlement can operate 24/7, reducing cut-off, weekend and holiday delays in eligible corridors.

- Fewer intermediaries: Stablecoin settlement can bypass multi-hop correspondent chains in corridors where they dominate, reducing failure points and unexpected fee leakage.

- Deterministic settlement proof: A single transaction reference with on-chain finality improves reconciliation and reduces payment-status ambiguity.

- Minimal programmable transitions: Funds held in platform-managed holds can be released under predefined rules, triggering automatic fee splits or routing logic, while discretionary decisions and dispute resolution remain off-chain.

- More responsive liquidity management: Treasury can rebalance stablecoin inventory across corridors intra-day, reducing prefunding requirements and improving payout capacity during demand spikes.

2.4 Market context and regulatory trajectory

Stablecoin adoption is accelerating beyond crypto-native use cases. Citigroup projects stablecoin issuance could reach $1.9 trillion by 2030, supply rose from $200 billion to $280 billion between January and September 2025 (Citigroup, 2025). McKinsey similarly highlights stablecoin transaction activity as part of broader global payments modernisation (McKinsey & Company, 2025).

However, regulators remain cautious. The Bank for International Settlements warns that stablecoins can fail key tests of "sound money" without robust regulation around reserve transparency, redemption guarantees and systemic risk (Bank for International Settlements, 2025). In the EU, MiCA establishes strict requirements for stablecoin issuers, including reserve backing and operational resilience standards (European Securities and Markets Authority, 2025). This regulatory tightening raises the compliance bar but also increases the credibility of regulated stablecoin providers as viable infrastructure partners.

2.5 Quantified impact: economics, EBITDA contribution and key assumptions

The case for blockchain-enabled settlement is not stablecoins are cheaper. It is, in a defined subset of payout corridors, stablecoin rails can reduce total payout cost and tail latency while lowering operational burden from payout failures and exceptions. The EBITDA contribution therefore depends on three measurable drivers:

- Eligible volume coverage: the share of payout value (and/or payout count) routed through stablecoin rails in corridors where legacy rails are demonstrably weak.

- Net unit-cost improvement: the all-in reduction in Upwork’s payout cost per $ (or per transaction), after custody, compliance operations, partner spreads and off-ramp costs.

- Operational savings: reduced failure rates, retries, trace activity and support tickets (a second-order lever that can be material if concentrated in a small set of problematic corridors).

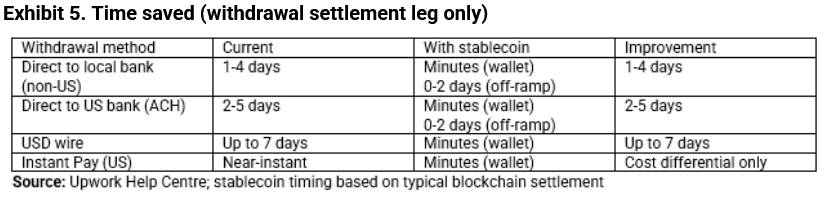

Time savings are concentrated in corridors where correspondent banking and cut-off windows create multi-day delays. For freelancers in cross-border corridors that rely on wire-style routing or weak local payout infrastructure, stablecoin settlement can compress post-approval payout time from multiple business days to minutes for wallet delivery, or same/next day in the practical case where the user converts to local fiat via an off-ramp. In contrast, where domestic bank rails are already fast (e.g., same-day or near-instant schemes), the incremental speed advantage of blockchain is modest and should not be the primary rationale for adoption.

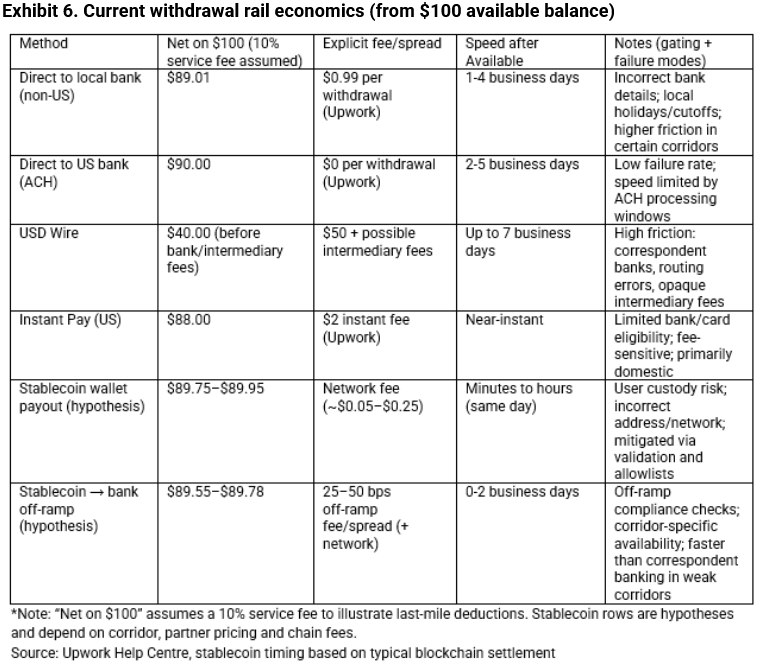

Where blockchain can win is not all payouts, but the subset where legacy rails have high intermediary cost and high exception rates. Traditional wires and correspondent-bank pathways can impose explicit bank fees and implicit intermediary deductions that vary widely by corridor and receiving bank. Stablecoin payout economics by contrast tend to be more transparent and more consistent on the settlement leg, with costs driven mainly by network fees and the off-ramp spread (if conversion to fiat is required).

Additional sources: Industry benchmarks for correspondent banking fees and intermediary deductions based on World Bank Remittance Prices Worldwide data and typical SWIFT wire costs; actual Upwork freelancer experience may vary by corridor and receiving bank.

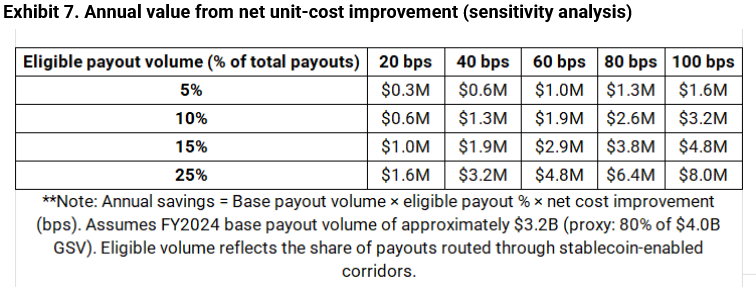

Sensitivity analysis shows how eligible corridor coverage and net unit economics combine to drive total value. Holding net improvement at ~60 bps (after custody and off-ramp costs), the savings case depends on concentrating adoption in corridors where incumbent rails are structurally expensive or failure-prone. Using a FY2024 base payout volume of ~US$3.2B, routing 1525% of eligible payout volume through stablecoin settlement implies approximately US$2.9MUS$4.8M in annual run-rate savings.

The key takeaway is not the headline number but the deployment logic: corridor discipline is the primary driver of ROI. Selective rollout in high-friction corridors generates higher savings per dollar routed; expanding into already-efficient domestic rails compresses net improvement and can remove the economic advantage.

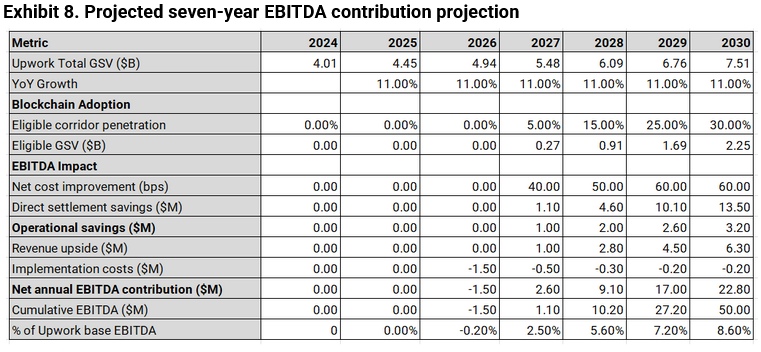

The seven-year model frames the opportunity as a staged rollout: adoption begins at low penetration and improves with corridor expansion only after operational processes and partner pricing stabilise. The model is designed to test whether a corridor-focused approach can produce meaningful contribution without requiring broad client-side behavioural change.

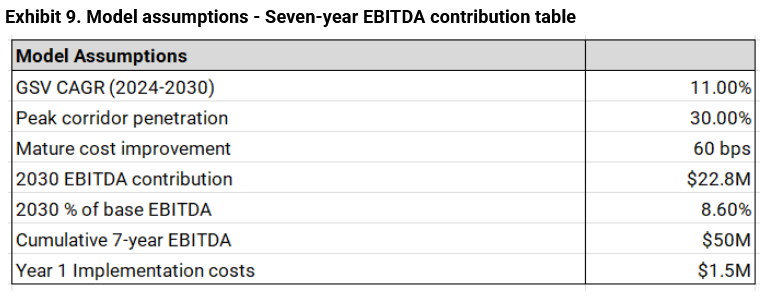

Exhibit 9 consolidates the headline assumptions used in the projection. These assumptions should be treated as testable: the purpose is to replace the most uncertain inputs with observed data.

Interpretation and strategic relevance

The seven-year model projects meaningful EBITDA contribution ($50M cumulative, 8.60% of annual EBITDA by 2030), but the strategic significance exceeds the headline numbers given Upwork's structural reliance on cross-border talent flows.

With 75% of talent based outside the U.S. whilst 70% of client spend originates domestically, the majority of Upwork's volume crosses borders. This creates asymmetric friction: clients experience seamless funding, whilst freelancers in emerging markets face multi-day delay and unpredictable fees with frequent payout failures.

Blockchain-enabled settlement supports Upworks long-term strategic goals by improving cross-border marketplace liquidity and strengthening freelancer retention in emerging markets. More reliable, faster and lower-cost payouts reduce a major source of friction that can push high-quality talent toward competitors or off-platform direct relationships, particularly in high-growth regions where local banking rails are slower.

3. Diligence and Validation

3.1 Assumptions, uncertainty and disconfirmation

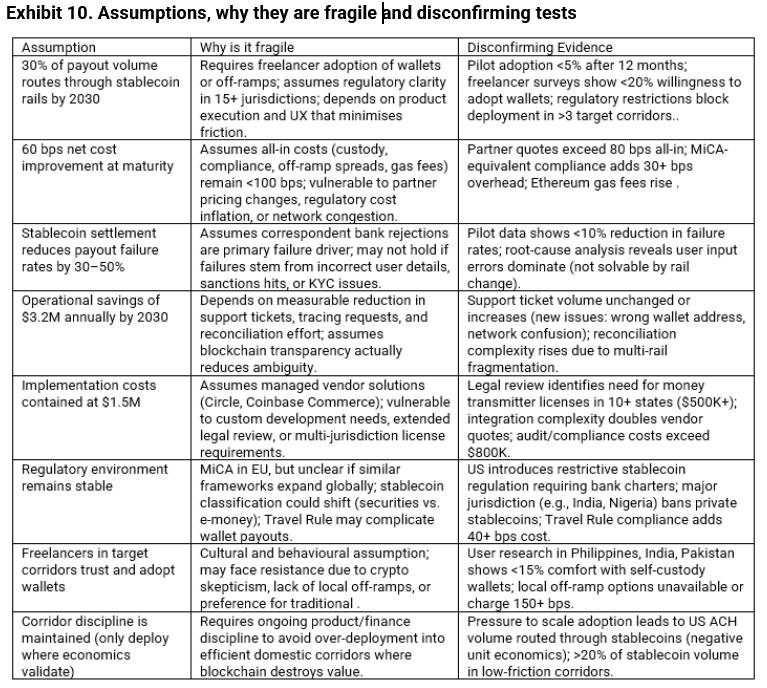

The most fragile assumptions are adoption, all-in cost control - the net improvement and operational savings realisation. These are behavioural and execution-dependent, not purely technical. Early pilot data is critical, if adoption stalls below 5% after 12 months or if partner quotes exceed 100 bps all-in, the business case collapses.

Exhibit 10 summarises the core assumptions behind the stablecoin-enabled payout thesis, explains why each is fragile and defines the evidence that would invalidate the case.The table also highlights execution and regulatory dependencies. Together, the disconfirming tests define a practical diligence plan - if pilot corridors fail to show meaningful adoption within a defined window, the investment case should be paused or narrowed.

3.2 Data sources and evidence stack

3.2.1 Internal data required (from Upwork)

- Corridor-level volume and payout method mix: Payout volume and transaction count by destination country (top 15 corridors); payout method distribution by corridor (wire, ACH, local bank, Instant Pay); average payout size and freelancer concentration by corridor.

- End-to-end payout latency and failure rates: Time from "available to withdraw" to funds credited by rail and corridor; weekend/holiday delay frequency; payout failure rate by rail and corridor, with root cause breakdown; manual review and retry frequency.

- Fully loaded current cost stack: Explicit fees and FX spreads by rail and corridor; support costs per payout-related ticket (failure tracing, status inquiries); total all-in cost per $100 paid out by corridor.

- Behavioural effects: Freelancer retention/churn by payout speed cohort; NPS/CSAT scores tied to withdrawal experience; support ticket volume correlation with payout corridor.

3.2.2 External data sources

- Stablecoin and infrastructure providers: Circle, Paxos reserve attestations and regulatory status; off-ramp provider (Coinbase, MoonPay, Transak) pricing quotes for top 15 corridors; FX spreads, settlement times and KYC requirements by corridor.

- Blockchain network and cost data: Ethereum and Layer 2s average gas fees and finality times over past 12M/2Y/5Y timeframe (if this will affect user fees in long run); wallet infrastructure pricing (Fireblocks, BitGo, Coinbase Custody API costs).

- Regulatory intelligence: MiCA implementation timeline and stablecoin reserve requirements (EU); jurisdiction-specific stablecoin treatment: India (RBI), Nigeria (CBN), US legislative proposals; FATF Travel Rule requirements and compliance tooling costs.

- Market and competitor benchmarks: Fiverr and other competitors payout method offerings; Wise, Payoneer, Deel cross-border payment pricing and corridor coverage.

3.3 Infrastructure Diligence

Stablecoin rails shift key risks away from correspondent banking networks and instead toward stablecoin issuers and off-ramp partners. Before deploying any stablecoin-enabled payout option, Upwork must complete rigorous vendor diligence to confirm regulatory compliance, operational resilience, security standards and sustainability across corridors.

The sections below outline the areas Upwork must evaluate in depth prior to integration. Without clear evidence of robustness in each area, rollout increases the likelihood of user harm.

Licensing and regulatory perimeter: Jurisdictions covered; ability to serve EU/EEA under MiCA requirements (capital, reserve transparency, operational resilience), consumer vs. business service restrictions, sanctions program (OFAC, EU, UN) integration and screening capabilities, money transmitter licenses in target US states (if relevant).

Stablecoin instrument characteristics: Issuer identity and regulatory status (e.g., Circle, Paxos, regulated e-money institution), reserve backing (1:1 fiat, composition of reserves, attestation frequency, independent audits), redemption rights and process (1:1 parity guarantee, redemption fees, delays), de-pegging history and contingency plan (circuit breakers, reserve transparency during stress).

On-ramp and off-ramp mechanics: KYC/KYB responsibilities (does partner handle, or does Upwork retain ownership?), payout methods supported (local bank transfer, card, mobile money) by corridor, typical FX spreads and conversion fees by corridor (request detailed pricing for top 10 corridors), processing cutoffs and settlement windows (same-day, T+1, T+2), failure handling and retry logic (automatic retries, manual intervention, refund process).

Compliance tooling and transaction monitoring: Wallet screening (sanctions lists, high-risk address flagging, chain analysis integration), Travel Rule support (FATF compliance for transfers >$1,000 if required), transaction monitoring and case management (AML alerts, investigation workflow, SLA for case resolution), audit trail and record retention (transaction logs, user activity, compliance event history).

Security and custody architecture: Key management (MPC, HSM, Shamir's Secret Sharing, segregation of duties); access controls and privilege separation (who can initiate withdrawals, multi-sig requirements); SOC 2 Type II or ISO 27001 certification (request most recent report); penetration testing and vulnerability management (frequency, third-party audits, bug bounty program); incident history (any breaches, loss events, or operational failures in past 3 years); insurance coverage (custody insurance, E&O, cyber liability limits and exclusions).

SLAs and settlement guarantees: Uptime commitment (99.9%+; historical performance data), finality assumptions (block confirmations required, reorg risk mitigation), dispute and refund flows (how are payment errors handled given irreversibility?), reversibility policies (under what conditions, if any, can transactions be reversed?), float and reserve requirements (does Upwork need to pre-fund partner accounts?), liability allocation (who bears loss in case of fraud, technical failure, or regulatory seizure?).

Reconciliation and reporting: API/webhook reliability (real-time transaction status, idempotency guarantees), deterministic transaction IDs (can Upwork map on-chain TxHash to internal ledger unambiguously?), audit logs and export capabilities (CSV, API access to historical transaction data), reporting cadence (daily settlement reports, monthly reconciliation support), support for Upwork's internal ledger mapping (flexible metadata tagging, custom fields).

Economics and commercial terms: Transparent fee schedule (per-transaction, percentage-based, volume tiers), FX spread disclosure (markup over mid-market rate, corridor-specific), implementation and integration costs (one-time setup, API access, developer support), termination clauses (notice period, data portability, wind-down support), volume commitments or minimum fees (any penalties for low adoption?).

3.4 Management Conversation

The objective is to compress uncertainty by speaking with the operator who owns payout performance and the executive(s) who set risk appetite. In a 15-minute conversation, the aim is to confirm whether payout friction is meaningfully concentrated, identify the corridors and payout methods driving that friction and surface any operational or regulatory constraints that would make a stablecoin-enabled rail non-viable.

Priority contacts (Upwork):

- Head of Payments / Payments Operations: Owns payout KPIs, provider performance, exception handling and corridor-level failure drivers.

- Head of Treasury / Treasurer: Owns liquidity strategy, prefunding, settlement controls and risk limits.

- Chief Compliance Officer / Head of Financial Crime: Owns AML/sanctions guardrails, jurisdictional constraints and approval thresholds for new payout methods.

- VP Product (Talent Payments / Payouts): Owns payout UX, eligibility rules, opt-in mechanics and support outcomes.

In the meeting, I would focus on pinpointing where performance breaks today and quantifying how concentrated those issues are by corridor and payout method. I would also map the current operating guardrails. The goal is to leave with a ranked shortlist of high-friction corridors where a stablecoin rail could plausibly improve outcomes, a clear split between rail-driven friction versus policy-driven friction (holds, identity verification, sanctions screening, risk thresholds) and explicit stop conditions that would make the initiative a non-starter (e.g., unacceptable exception patterns, inability to reconcile cleanly, reduced visibility into payout status, or unacceptable constraints around reversals and controls).

Conclusion

Upworks core economic engine is inseparable from payments: the platform only monetizes when client funds clear, escrow states resolve cleanly and freelancers can withdraw reliably across borders. The most defensible blockchain thesis is therefore a selective settlement overlay in the small set of corridors where legacy payouts remain structurally slow. A hybrid approach, where keeping compliance, disputes and accounting off-chain while introducing stablecoin rails for eligible withdrawals can improve unit economics, reduce tail latency and lower exception-driven operational load. The investment-grade next step is a gated pilot that proves (or disproves) adoption, fully-loaded bps improvement and risk containment in targeted corridors; if those gates clear, the rollout becomes a disciplined expansion of a validated operating advantage.

Sources

- https://investors.upwork.com/static-files/89a97fe0-2955-481c-94a6-fa184b1c2d9c

- https://investors.upwork.com/news-releases/news-release-details/upwork-reports-fourth-quarter-and-full-year-2024-financial

- https://support.upwork.com/hc/en-us/articles/211063888-How-to-withdraw-earnings-with-Direct-to-Local-Bank

- https://www.bis.org/publ/arpdf/ar2025e.pdf

- https://support.upwork.com/

- https://www.upwork.com/resources/is-upwork-free

- https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

- https://www.citigroup.com/global/insights/stablecoins-2030

- https://www.citigroup.com/rcs/citigpa/storage/public/GPS_Report_Stablecoins_2030.pdf

- https://www.mckinsey.com/industries/financial-services/our-insights/global-payments-report

- https://remittanceprices.worldbank.org/

- https://documents.worldbank.org/en/publication/documents-reports/documentdetail/401951467999676978/remittance-prices-worldwide-report

- https://www.fsb.org/uploads/P191224.pdf